TF_Import.xlsx

General Information

The TF_Import.xslx file is mandatory for every analysis run and allows various settings. These are general configurations or analysis specific.

The Excel file can be found in the customer area on our website in the archive dabAnalyticSuite_StartScript_2_2_XX.zip.

After downloading and extracting, the file can be used for configuration. Various worksheets are available for this purpose:

Worksheets

Critical_Countries

Define the critical countries.

The table contains three columns:

- First column: contains country key (short form of each country)

- Second column: contains the full name of each country

- Third column: contains the reason why this country was listed as critical

Reasons for categorising as critical:

- CPI (Corruption Perception Index): We consider any country with a CPI below 50. For a list of all countries and their CPI, see the CPI_allCountries worksheet or the Transparency homepage.

- Tax Havens: Our source for the definition of tax haven countries is the following website: Tax havens.

The list should be adapted to your own requirements, if analyses are used that refer to critical countries. Otherwise, the standard definition is used.

CPI_allCountries

- List of all existing countries and their CPI (Corruption Perception Index).

If countries are removed from this list, this will not affect the analyses. This table is for informational purposes only, so that an informed decision can be made as to whether or not a country should be considered critical.

Critical_Text

- Lists all keywords for the search for critical texts

- Searchtext column: stores the keywords for which the GL_Critical_Texts analysis is searching in the posting texts of the general ledger

- New search words can be added or deleted

- Area column: keywords can be categorized in order to filter and visualize the hits more easily in the result

- Whitelist: To avoid unwanted hits, disarm search words by listing in which contexts the word may occur

GL_CriticalTexts_Include_Paym

- Only relevant for test step GL_Critical_Texts

- Critical texts: generally not taken into account for payments, as they usually already appear in sales-effective postings (invoices, credit notes), which are then offset by the payments

- Prevent double consideration: critical text would otherwise appear both in sales-effective postings and in the payment

- Company Codes: definition possible for which company codes critical texts should still be taken into account for payments

Exclude GL Accounts

Exclude search for critical posting documents for certain accounts: account number and account sheet are stored in this table for this purpose

CC_PaymPostings

Prevent double viewing: critical text would otherwise appear both in payment postings and in the payment itself

Company codes: definition possible for which company codes critical texts should still be taken into account for payment postings

GL_Comission_Accounts

Evaluation of commission postings: affected accounts including chart of accounts must be stored here

PaymentTerms_WhiteList

- WhiteList: these entries are automatically excluded from the result

- PaymentTerms_WhiteList: only relevant for CU_PaymTerms

IncoTerms_WhiteList

- WhiteList: these entries are automatically excluded from the result

- IncoTerms_WhiteList: only relevant for all CU_Incoterms and VE_Incoterms

AU_Critical_Profiles

- List of profiles or roles: considered for generating the result of the AU_Critical_Profiles analysis

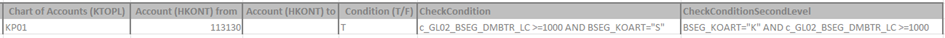

GL_AccountCheck

- Define check conditions: necessary so that the evaluation shows the searched postings in the result

- SAP system and Client

- Number and describe individual test conditions: description can also be found in the result

- Per G/L account and chart of accounts: describe search criterion in the form of a filter in the ACL scripting language (either a specific account or a range can be specified for G/L account)

- Condition field: defines whether the condition in the CheckCondition field must be true or false (value = T or value = F)

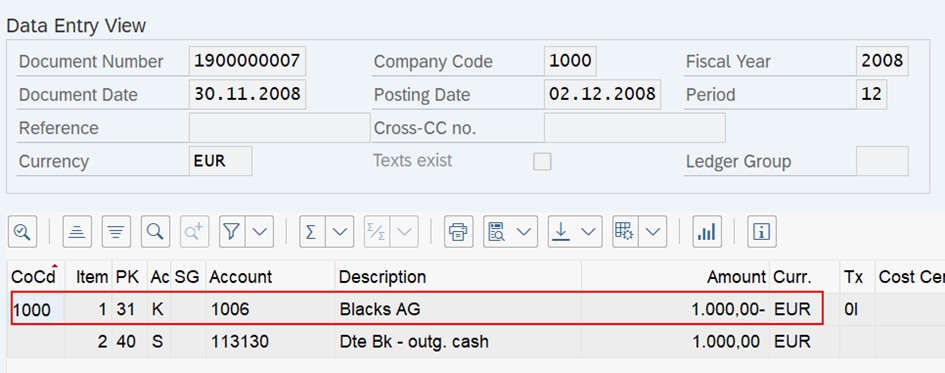

In the following example, all posting lines to account 113130 with account type S and an amount >= 1000 would be identified:

If the CheckConditionSecondLevel column is also filled in with a condition, the posting line(s) with account type K and amount >= 1000 are output in the result within this posting process instead:

All columns available in the GL_BaseTable can be used to define the conditions.

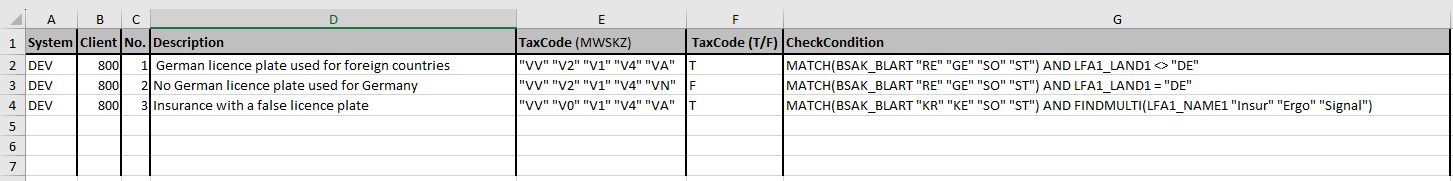

AR_TaxCodeCheck & AP_TaxCodeCheck

- Create a set of rules based on certain conditions: provides a description of the data set if the defined rule (one or more rules possible) is fulfilled

- Important: A data set can be described by several rules simultaneously after the analysis has been performed.

There are two ways of displaying the description:

- Data set fulfils only 3 of the defined rules: a detailed description is displayed in the Description field for each applicable rule. They are separated by a semicolon.

- Data set fulfils more than 3 of the defined rules: the entry More than three conditions fulfilled is entered in the Description field, together with the rule numbers from the definition file.

System | Client | No. | Description | TaxCode (MWSKZ) | TaxCode (T/F) | CheckCondition |

|

|

|

|

|

|

|

- System: name of the SAP system (stored in the SAP system area in the parameter v_DL_SAP_SystemID_SAP), normally the system ID (SID)

- Client: SAP Client (MANDT), from which the data download is carried out

- No. (Number): Role number specified by the user, used for display (standard numbering 1, 2, 3, etc. is used here)

- Description: Role description specified by the user, used for display (by default, this is a text describing the filter syntax)

- Tax Code (MWSKZ): User specifies control indicators (BSAK_MWSKZ / BSAD_MWSKZ) to be used in filtering and checking. The tax indicators are placed in inverted commas. If more than one indicator is specified, they are separated by a space. Example: "AA" "BB" "CC"

- Tax indicators: parameters with the values T or F

- T: searches for data records that contain the tax codes specified under Tax Code

- F: searches for data records that doesn't contain the tax codes specified under Tax Code

- CheckCondition: allows users to specify an exact condition to be applied in addition to the tax code. The user can create a syntax of fields that exist at the base table level.

- Example: specified condition checks a field - country field LFA1_LAND1 <> "DE"

- Example: specified condition checks several rules with an AND/OR composition - MATCH(BSAK_BLART "RE" "GE") AND LFA1_LAND1 <> "DE" - If OR is used, the brackets ( ) must be placed in the correct position!

Examples for AR_TaxCodeCheck:

KPIWiz

- KPIWiz: offers the possibility to summarize analysis results according to certain criteria. This generates additional result tables with KPIs.

- An explanation of this result can be found here

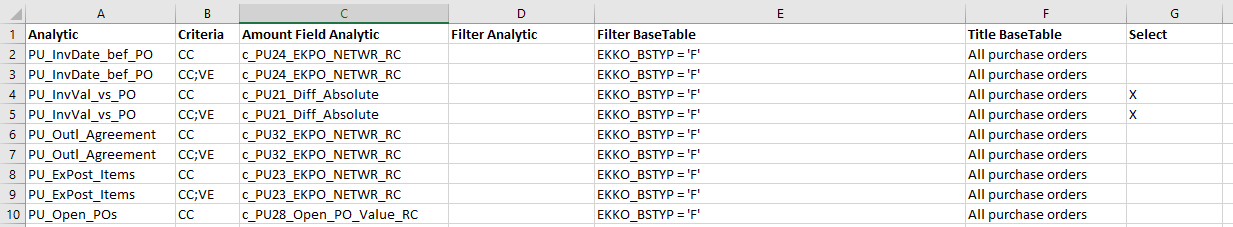

Configuration

Column Name | Description of the Column | Editable Column? |

Analytics | Name of the analysis for which a KPI result is to be created | No |

Criteria | Different summarization criteria are possible (can be combined): CC = Company code VE = Vendor CU = Customer | No |

Amount Field Analytic | This column shows which numeric field is being totaled | No |

Filter Analytic | This column shows, for which filter criterion in the analytic the summarization is being made | No |

Filter Base Table | This column shows, for which filter criterion in the BaseTable in the summarization is being made | No |

Title Base Table | This column shows you the name of the corresponding BaseTable | No |

Select | Here you can select, whether you want to create KPI table for that analytic or not. Set an X to select the KPI | Yes |

Module Description

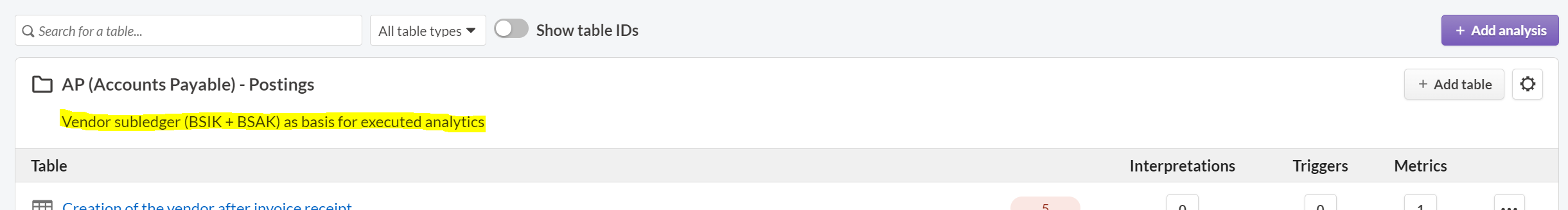

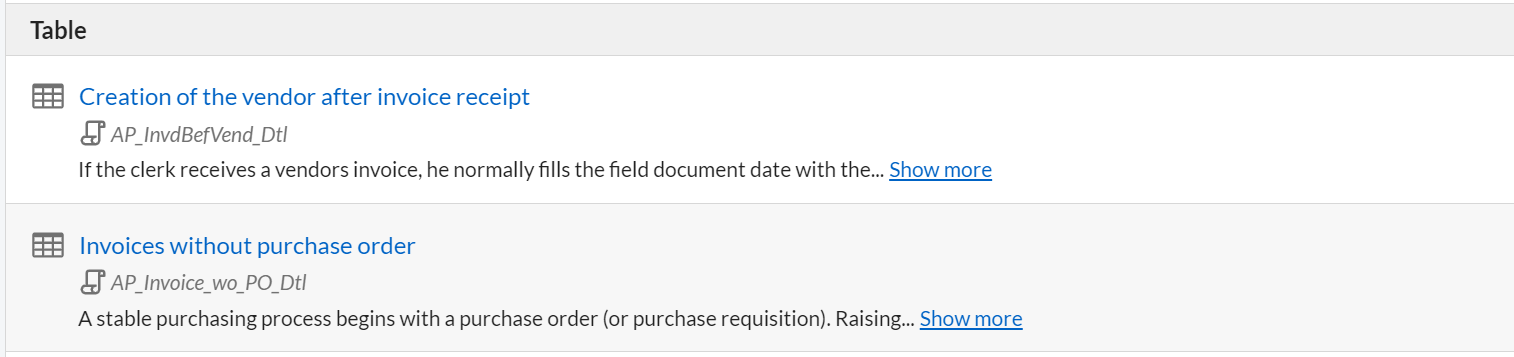

- Module Description: is used for uploading the results to the results module

- Texts maintained here serve as descriptions of the analyses (folders)

Table Description

- Table Description: is used for uploading the results to the results module

- Results tables maintained here and their description texts are displayed in the results module

FieldListSelection

- FieldlistSelection: is used to upload the results to the results module

- Stored columns (per results table) & column title: selectable for upload to the results module

- Conversion to a dab Link: specifies whether the conversion should be performed or generated dynamically

- Column export to Excel: can also be defined in addition to the column selection for uploading to the results module

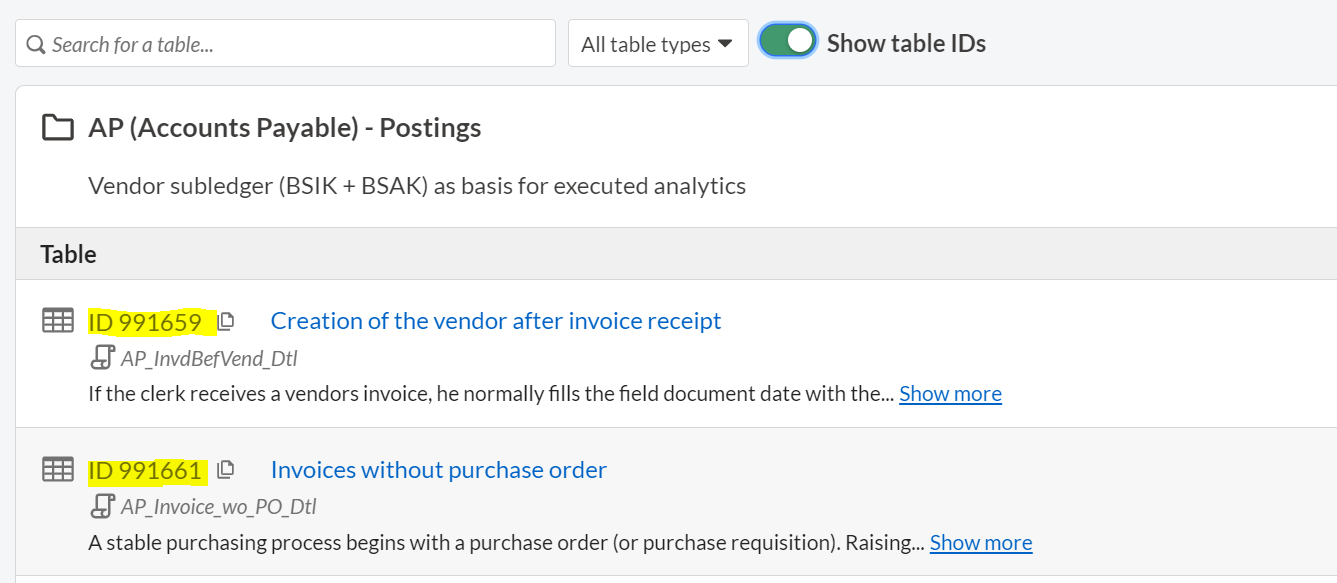

ScheduledResultsUpload

- ScheduledResultsUpload: is used to upload the results to the results module

- Table ID: must be stored if an analysis result is to be uploaded to an existing table

- Slider to show table IDs: this allows table IDs to be displayed in the results module

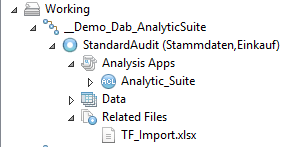

Storing .xlsx file

- Correct use of TF_Import.xlsx: File must be placed in the correct position:

- ACL AN Desktop: In the folder where the Analytic_Suite start script is located

- ACL AX: In the associated files of your AnalyticSuite Collection

- Robotics: under Input/Output the TF_Import file is stored and saved