VAT-ID Checker

General Information

The analyses of the VAT-ID Checker are used to check the VAT-ID of your customer (CU_VAT_ID_Check) or vendors (VE_VAT_ID_Check). This article describes how to set up the VAT-ID Checker in dab AnalyticSuite and how to run the analyses.

License Check

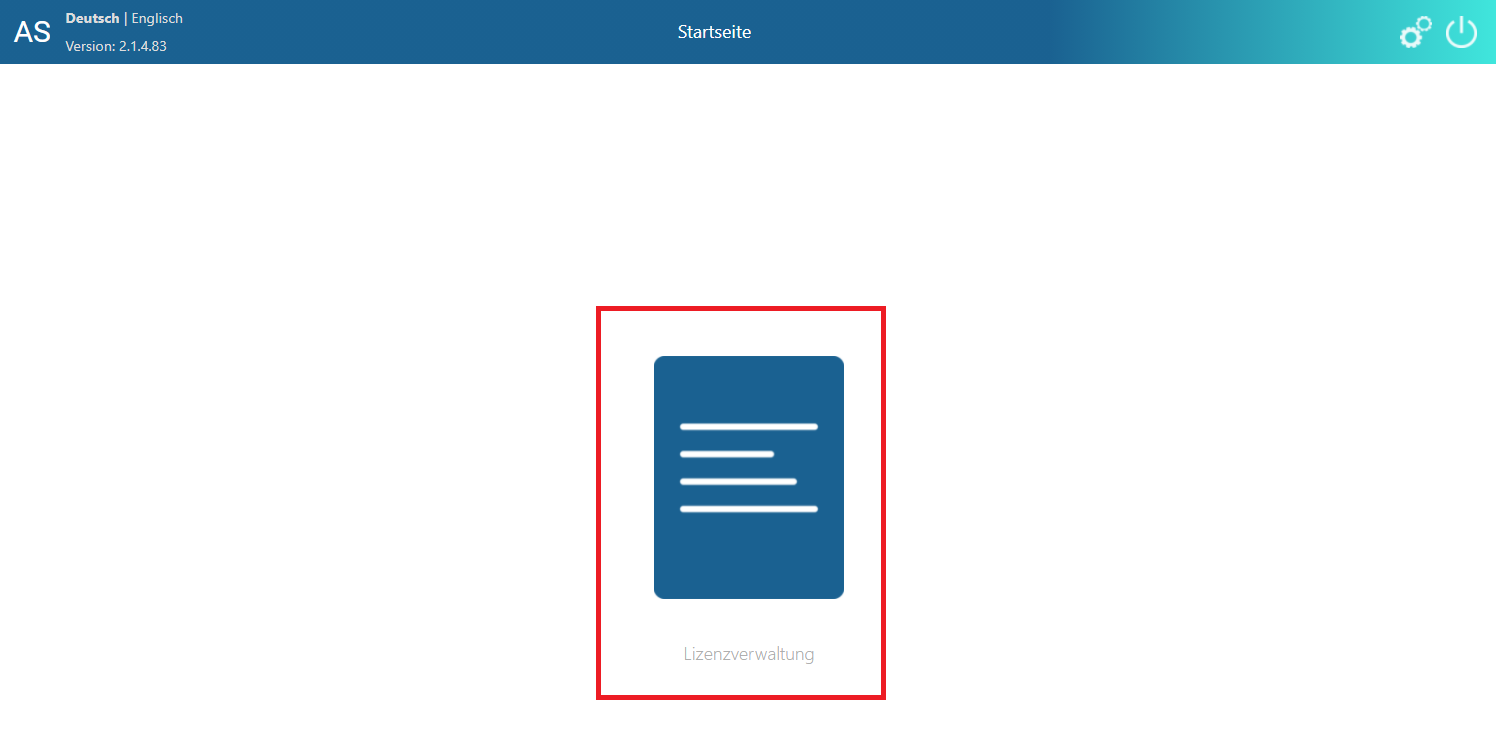

- Open your browser and connect to the dab AnalyticSuite interface: http://localhost:5000

- You can find more information about the login and or the login-data in this article: dab AnalyticSuite Aufruf und Anmeldung

- After you have successfully logged in, select license management

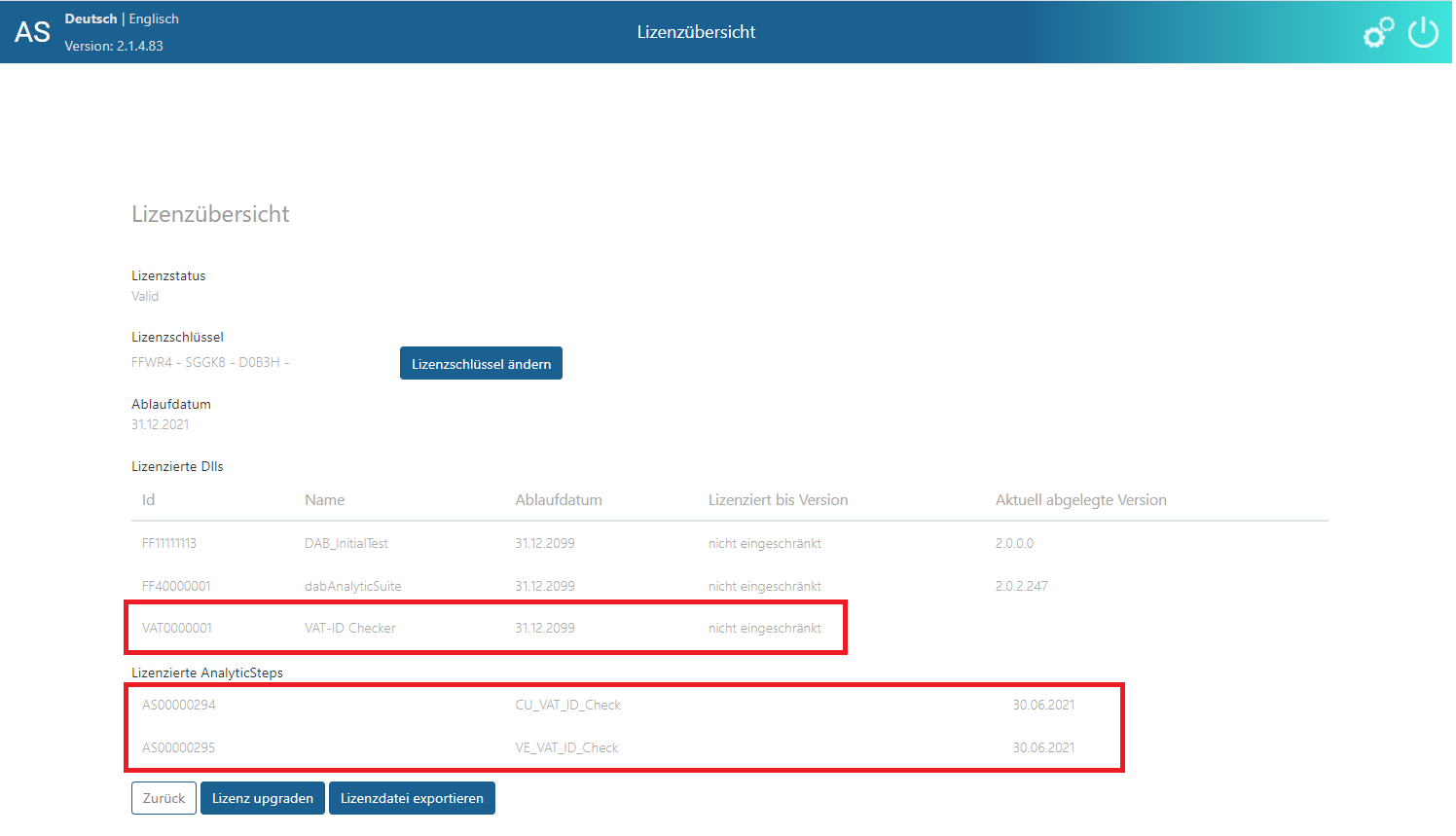

- In the License Overview, in the Licensed DLLs section, the following entry must exist with an expiration date in the future:

DLL | Description |

VAT0000001 | VAT-ID Checker |

- in the Licensed AnalyticSteps section, you will need the following entries, also with an expiration date in the future:

ID | Name | Description |

AS00000294 | CU_VAT_ID_Check | Check the customer VAT-ID |

AS00000295 | VE_VAT_ID_Check | Check the vendor VAT-ID |

ACL-Environment Setup

- The EXECUTE-Command must be allowed in the ACL Environment. For this, please refer to the following links to the respective instructions:

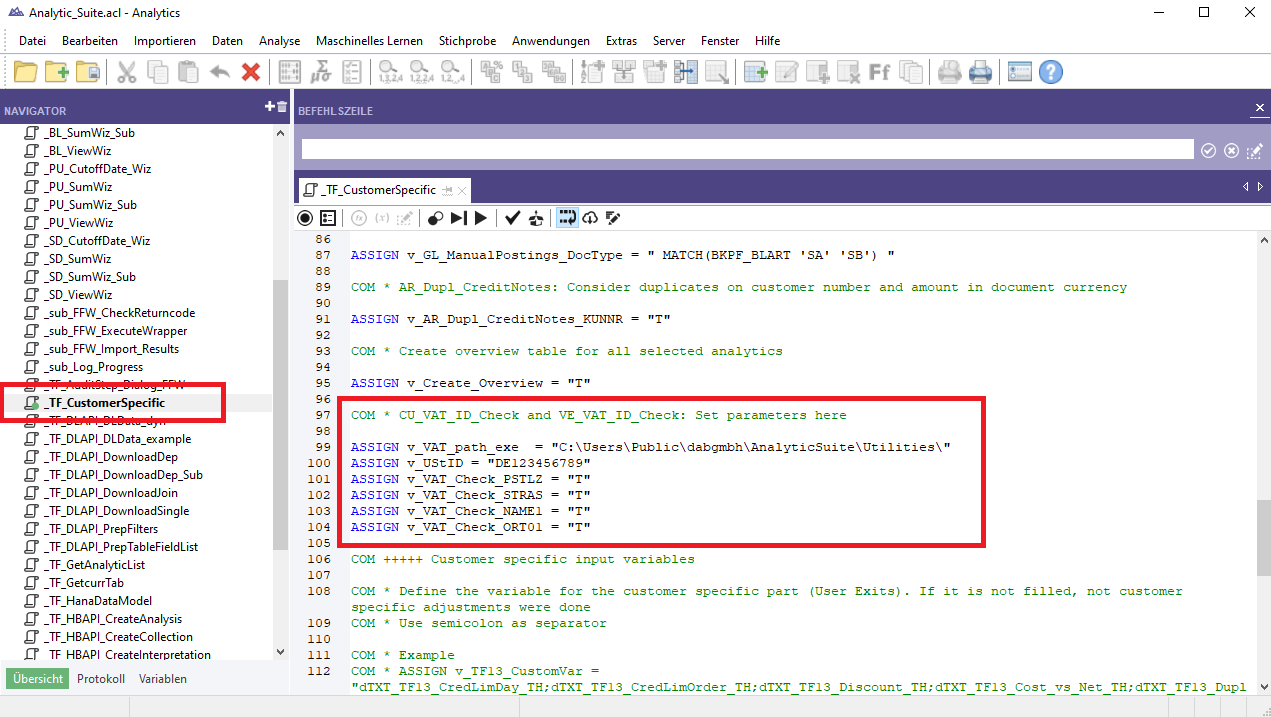

- Make adjustments the dab AnalyticSuite_StartScript -> Analytic_Suite.acl

- For this please open the script file _TF_CustomerSpecific and adapt it customer specific

Variable | Description |

v_VAT_path_exe | In this path where the dabUSTChecker.exe is stored and executed. Here you can also find the log files for the executions. Default: C:\Users\Public\dabgmbh\AnalyticSuite\Utilities\ |

v_UStID | Here you enter your own VAT ID, which is required for the queries to the services |

v_VAT_Check_PSTLZ | Determindes whether the postal code is taken into account during the check -> T = Yes; F = No Default: T |

v_VAT_Check_STRAS | Determindes whether the street is taken into account during the check -> T = Yes; F = No Default: T |

v_VAT_Check_NAME1 | Determindes whether the name is taken into account during the check -> T = Yes; F = No Default: T |

v_VAT_Check_ORT01 | Determindes whether the city is taken into account during the check -> T = Yes; F = No Default: T |

Network

For the execution of the VAT-ID Checker it is mandatory that the following URLs ( Internet addresses) are accessible from your network. These websites are free services for retrieving VAT information of the German Federal Central Tax Office and the European Commission.

European Commission Webservice: http://ec.europa.eu/